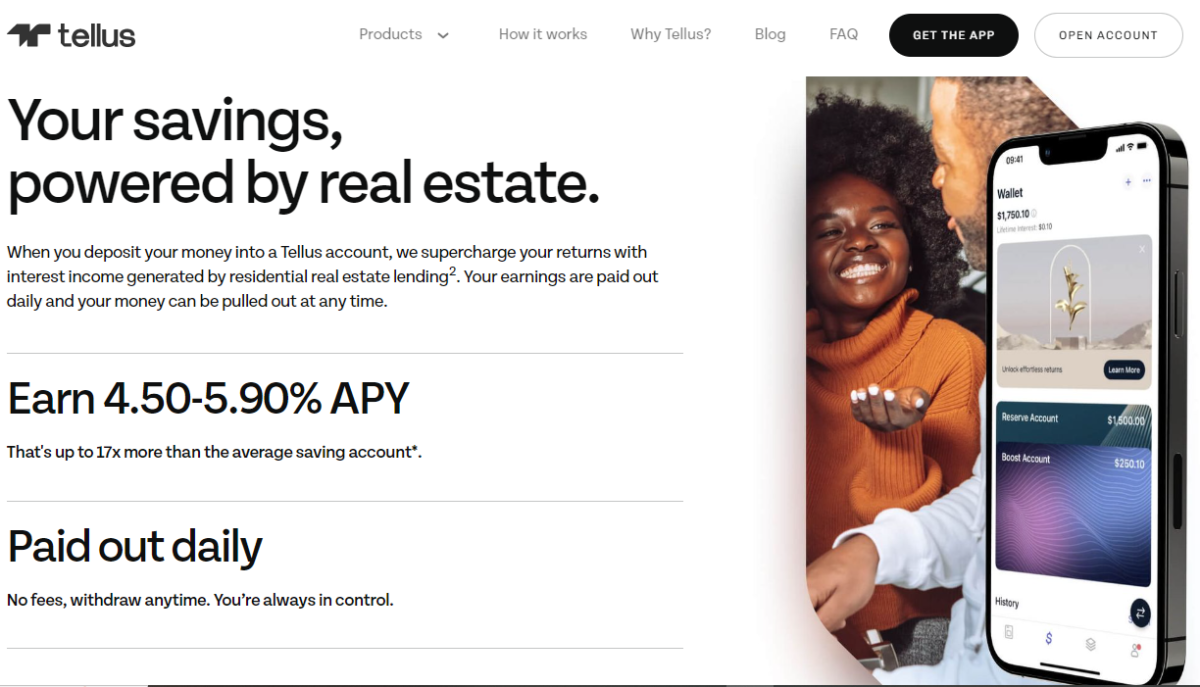

Real Estate That Pays Like A High Yield Savings Account

If you want to build wealth, you may think you need to invest in stocks, cryptocurrencies or other volatile markets. Fortunately, Tellus provides an alternative to help you increase your net worth.

Our Tellus review shares how this app can pay you interest rates that average 17X what the typical bank will pay you on your savings balance.

Summary

Tellus provides a wide range of savers the option to earn passive income through real estate. Low minimums and no fees make saving easy for most everyone. However, the lack of diversity and risk of loss should be considered before signing up.

Pros

- Free to use

- No account fees

- Passive real estate income

- Low minimum deposit

- 100% liquidity

Cons

- Products limited

- Minimal customer service options

What is Tellus?

Tellus is a completely free savings app powered by real estate. The fact that it relies on real estate allows you to earn much higher interest rates than you would on a traditional savings account.

This platform allows users to earn up to 5.90% APY. Plus, you can withdraw your money at any time with no fees.

Better yet, using Tellus helps you avoid the volatility of investment options like cryptocurrency or the stock market. Essentially, it’s a way to earn passive income with minimal risk.

How Does Tellus Work?

Tellus funds mortgage loans to homeowners. These loans typically have six to 18-month terms and, according to Tellus, are always sufficiently collateralized.

The company also has a property management platform that produces additional revenue and provides helpful resources for property owners.

As a saver, Tellus helps you earn a higher interest rate on the money you save. As of this writing, Tellus Boost account owners earn at least 17X more interest on their balances than other savings accounts.

When you earn higher interest on the money you save, you can achieve your financial goals faster. However, the risk of potential loss in the event of a real estate market downturn or a defaulted loan is real.

That said, real estate tends to be more of a stable market and not quite as volatile as investing in stocks or cryptocurrencies.

Here’s how to get started with Tellus.

Make a Deposit

Opening a free Tellus Boost account takes just a few minutes. Anyone at least 18 years of age who is a legal U.S. resident can open a Tellus account.

There is no deposit required to open an account and browse the app. However, there is a minimum funding amount/balance requirement of $125.

Depositing this minimum allows you to start earning interest right away. Note that Tellus is not a bank, but the funds held in your cash management account with Tellus are custodied by well-known banks such as Chase.

You also have the option to use Tellus Vaults if you want to secure a higher interest rate. These function like Certificates of Deposit (CDs).

Tellus Puts Your Money to Work

Tellus uses your money to fund mortgage loans. Then, you’ll earn daily interest on your balance.

The platform also protects your money with its Triple-Layer Protection framework:

- Collateral: Every dollar Tellus lends is backed by U.S. single-family residential real estate, primarily in the Pacific Northwest market.

- Capital: Tellus holds U.S. dollars in proportion to every dollar saved by its users as an additional protection buffer.

- Systems: The platform boasts bank-level AES 256-bit encryption and partners with Stripe, Plaid, IDology and Riskified to protect your money and identity.

With these layers of protection, you can rest easy knowing that your investment is as safe as possible.

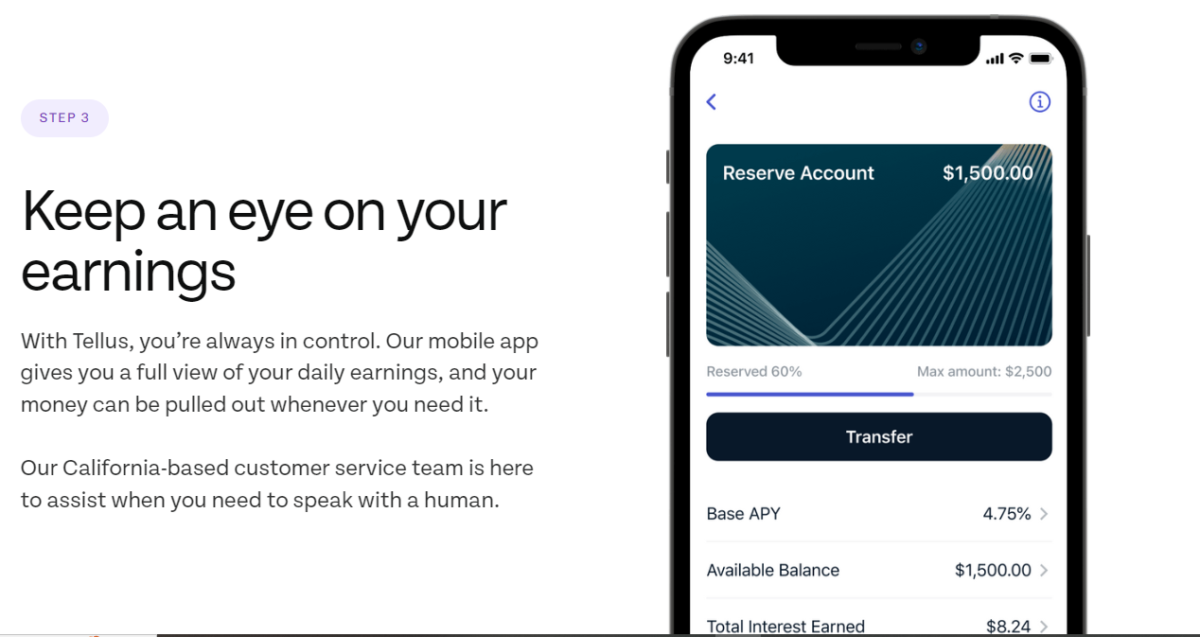

Monitor Your Earnings

You can keep an eye on your account within the app and see how much you’ve earned each day. Plus, you can cash out your money whenever you need it.

In the app, you’ll be able to see things like your base APY, the balance you have available, how much interest you’ve earned and more.

Plus, if you need support, you can also live chat in the app with Tellus’ California-based customer support representatives for assistance with your earnings, deposits and cashing out.

Boost, Budget and Automate

With Tellus, you get extra tools to do things like fast-track your earnings, automate your contributions and even set goals, making the app more than just a way to earn passive income.

The Boost feature is a tool that allows you to earn even more interest on your balance for a set period of time. Boosts are random but occur frequently.

To take advantage of boosts, you need to access your Tellus account every day and activate a Boost if it’s available.

You can also earn Boosts by answering quiz questions. These Boosts can help you earn more on your Tellus savings for short periods of time.

Tellus allows you to make deposits whenever you want. Beyond that, the app lets you budget for regular Tellus contributions and have automatic deposits made into your account.

In addition, you can put your savings into buckets with the Stacks feature to help you reach your different financial goals. This can help you with budgeting.

Cash Out

Another attractive feature about Tellus is that you can cash out your investment at any time. You can even cash out the day after you deposit your money, giving your investment 100% liquidity.

There are no term requirements for the Boost savings account and no fees for withdrawing your money with this account. However, you may lose any interest you accrued if you cash out a Tellus Vault early.

How Much Does Tellus Cost?

There are no fees for becoming a member of Tellus or for using the platform. It’s absolutely free.

However, your bank might charge you fees for some Tellus transactions, such as wire transfers into or out of your Tellus account.

Tellus does its best to notify you of bank or other fees that partner institutions charge, but the platform itself does not charge any fees.

Keep in mind that the site does require a minimum account funding amount/minimum balance of $125 for you to earn interest through the app.

Is Tellus Worth It?

Tellus provides a way for you to earn an attractive yield on your savings balances. However, the funds you put into your account are not without risk.

As with any investment, real estate can be risky. Downturns in the economy, loan defaults and other factors could put your deposited funds at risk of loss.

The platform minimizes these risks by having large cash reserves and well-collateralized loans. Nevertheless, any borrower could default on a loan at any time, which would result in a loss of investment for you.

It’s up to you to decide if the potential yields are worth the risk.

Other real estate investment options include Fundrise. This platform allows you to invest in commercial real estate rental properties for as little as $10.

There are other real estate crowdfunding platforms for you to consider investing in. Additionally, there are plenty of real estate investing opportunities for non-accredited investors as well as accredited investors.

Keep in mind that whether you invest with Tellus or other real estate investing platforms, all real estate investing comes with the risk of loss of your initial investment.

Tellus Features

The following features come with every account.

Earn 4.50% on Deposits

The money in your Tellus Boost account earns at least 4.50% APY as of this writing. Although there are a few high-yield savings accounts that earn in this range, most don’t pay that much.

The interest rate on a Tellus Boost account fluctuates, but the fintech’s goal is to keep the interest rate attractive to reward members for partnering with them.

Tellus Vaults

Tellus also offers a product called a Vault. When you save using a Vault, you’ll lock your money up for a specified period of time, similar to how a CD works.

There is a minimum $1,000 deposit amount you must adhere to if you want to put your money in a Vault. Terms range from 3–24 months, with the interest rate being higher for longer periods.

If you don’t need liquidity from your investments, Vaults could be worth considering.

Withdraw Your Money Anytime

You might appreciate that you can withdraw the money in your Tellus Boost account at any time. There are no terms with Boost and no penalty for taking your money out early. You can withdraw your Boost contributions as early as the next day.

With Tellus Vaults, you can also withdraw your money at any time. However, doing so will cause you to forfeit any interest you’ve accrued.

Interest Paid Daily

Tellus pays earned interest daily into your Boost account. Better yet, you can also withdraw that earned interest right away.

This can be a great way to make money fast.

Comparison Calculator

The platform also offers a savings calculator on the homepage. This calculator can help you compare how money in a Tellus Boost account compares to money saved in a traditional savings account over specified periods of time.

As an example, if you deposit $100 per month into your Tellus Boost account over a 10-year period at the current interest rate, you could have as much as $58,043 in your Tellus Boost account.

However, if you put that same $100 monthly in a typical bank savings account, you’d only have $36,703 at the end of those ten years. That’s a huge difference.

Visit Tellus’ homepage to use the comparison calculator and see how much more money you might be able to earn with the platform.

Tellus Customer Reviews

Before signing up for any financial product, it can be helpful to know what other customers have to say about their experience.

Here’s how Tellus stacks up on the different rating sites:

| Website | Score | Number of Reviews |

| Apple App Store | High | 4.4K |

| Google Play | High | 791 |

| Trustpilot | High | 34 |

Here are some Tellus review excerpts from customers:

“I really LOVE saving with Tellus……Plus there is the daily boost. So it’s always above the 4.5%. Been saving for well over a year now with them.” – Kathleen S.

“I’m having serious issues with getting customer service to help me. I can’t find a way to get someone on the phone……..” – Kyle

“Easy way to save money while earning high interest. It’s a pretty simple concept: deposit the money and they pay you (the specified) interest. I’ve had a couple of problems with the app but support was really good about helping.” – Drew P.

“I just invested with Tellus because of the great reviews online…..Yet no one appears to be home after numerous attempts to reach a customer service rep.” – MarinKat

Frequently Asked Questions

If you are still on the fence about using Tellus, these frequently asked questions might be able to help.

Summary

With low minimum deposit requirements and no fees, Tellus provides an attractive savings option. It offers a way to tap into the power of real estate and earn a higher interest on your savings, all while keeping your cash liquid.

As long as you keep the risk level in mind, you might find Tellus to be a good option for you to make passive income with real estate.